WHO WE ARE

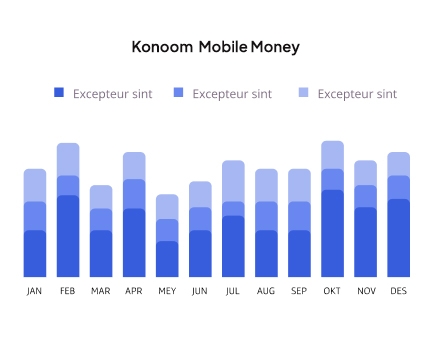

KONOOM Mobile Money is a digital financial services provider specializing in electronic money payment solutions. Designed to support financial inclusion, KONOOM Mobile Money offers a secure, fast, and user-friendly platform for managing daily transactions, personal finances, and business payments — all through a digital wallet ecosystem accessible via mobile app, USSD, WhatsApp, and web.

Neque porro quisquam est, qui dolorem ipsum quia dolor sit amet, consectetur, adipisci velit, sed quia non numquam eius modi tempora incidunt ut labore et dolore magnam aliquam quaerat voluptatem.

Consectetur adipisci velit sed quia non numquam eius modi tempora incidunt ut labore et dolore quaerat voluptatem.

Consectetur adipisci velit sed quia non numquam eius modi tempora incidunt ut labore et dolore quaerat voluptatem.

Consectetur adipisci velit sed quia non numquam eius modi tempora incidunt ut labore et dolore quaerat voluptatem.

Abakar Mahamat ADOUM FORTEY and Brahim Moussa HASSANE, co-founders of KONOOM Mobile Money, are two experienced bankers who share a passion for technology and innovation. They decided to tackle the challenging issue of financial inclusion for populations excluded from the traditional banking system. Their strong background in the banking and financial sectors forms the foundation of their commitment to transforming the merchant payment sector, money transfers, and public savings collection through a digital wallet accessible to everyone, anytime, and anywhere.

A senior bank executive with over two decades of experience in commercial and retail banking. He has developed deep expertise in risk management and operational leadership over the years. He has strong command of credit institution governance frameworks in the UEMOA zone, as well as a good understanding of the banking markets in Chad, Senegal, and Niger. He also has a solid grasp of Islamic finance.

Holder of a Master’s degree in Investment and Corporate Governance, with a specialization in Financial Engineering, as well as an ITB diploma in Banking Management. He is passionate about innovation and sustainable performance. He has more than a decade of significant experience in financial analysis and commercial management, primarily gained in Senegal and Chad.

A seasoned executive with over 15 years of experience in the financial and technology sectors, MBANDA Jonathan Jonas currently serves as the CEO for Cameroon. He has built a strong career across multiple African markets, including Senegal, Chad, the Democratic Republic of Congo, and Cameroon. Over the years, he has developed a deep understanding of mobile wallet ecosystems and the operational challenges that shape the digital payments landscape.

Bringing digital payments to everyone, especially the unbanked.

Full adherence to financial regulations, legal compliance, anti-money laundering (AML) laws, and CFT (Combating the Financing of Terrorism)

Ensuring every user feels confident and in control of their transactions.

Commitment to Data Privacy

To simplify electronic payments, promote financial inclusion, and ensure data privacy and regulatory compliance by delivering secure, innovative, and user-friendly financial solutions.

To be the most trusted and accessible digital payment platform, driving financial empowerment and inclusion for every individual and business, across every corner of the nation.

Bank Executive

A senior bank executive with over two decades of experience in commercial and retail banking. He has developed deep expertise in risk management and operational leadership over the years. He has strong command of credit institution governance frameworks in the UEMOA zone, as well as a good understanding of the banking markets in Chad, Senegal, and Niger. He also has a solid grasp of Islamic finance.